A global archive of independent reviews of everything happening from the beginning of the millennium

Read our Copyright Notice click here

For publication dates click here

For

Comment 2012 click here

For Comment 2013 click here

For

Comment 2014 click here

For

Comment 2016 click here

Comment reviews respond to changing events in real time, like a blog.

Comment reviews:

An Alternative HypothesisArbitration

and the Press

Public Speech

3 October 2016

It is good to see the new Secretaries of State for Communities, Sajid Javid, bring forward proposals today to build more residential housing near railway stations and on government land, much in line with what was proposed here.

COMMENT 2015

____________________________________________________________________________

11 April 2015

London used to have a height limit of 90 feet for residential property. There were a lot of practical advantages to this.

Really bad overshadowing was curtailed if by no means eliminated.

Firemen could rescue people by carrying them down six storeys or fewer by the staircase or with the aid of ladders.

The angst expressed in Howard's End about overdevelopment found a resolution in the legislation that brought in this height limit.

London's charm, as a place to live in since Georgian times, has been that it is a horizontal city not a vertical one.

Britain was slow to take on Le Corbusier's ideas about residential point blocks but in the 1960s some experiments with high rise were initiated - like the towers in Roehampton.

For a few years this seemed like an answer in terms of council provision until some seminal academic research showed that you could accommodate just as many people by building at relatively low rise, at 4-5 storeys high, because the wide open and windy spaces around tower blocks could be eliminated and used more actively.

The Ronan Point gas explosion disaster also put a nail in the coffin of building more council high rise. The system-built block looked low quality when blown apart.

So London survived to the millennium with the reality that, residentially, it was largely a horizontal city.

Of course, there are places where overshadowing and overlooking neighbours matter less - in financial districts, along the edges of railway lines, on former industrial sites and in the wide open spaces of docklands.

Canary Wharf financial district

In the 1970s a family of four living in a house in London, whether private or council, might typically have a house of four bedrooms at their disposal.

Today they might typically be living in a flat in a house conversion, or in a purpose built block, with not much more than half the floor area of the 1970s house dweller at their disposal.

Though the price of residential accommodation has escalated in many parts - probably most parts - of Britain relative to earnings this adjustment in available living space has almost certainly been at its most severe in London.

Sometimes one has to take the counter-intuitive solution to get the right answer.

Families do not choose to live in high rise except when they have to. In Manhattan, Hong Kong and Monaco they may have no choice but the arrival of near universal high rise in these places over the past forty years does not mean they have become cheaper to live in.

On the contrary. So London should keep well clear of going down this route.

The reason is counter-intuitive but fairly obvious.

If the contiguous plots of half a dozen houses can make way for a block with a hundred flats then the land price component of all nearby house plots goes up.

Were the new flats to be priced significantly below nearby stock then a downward effect of additional supply might obtain but most new high rise, especially in London, sells itself as having premium finish and at no discount to local prices.

So those at the lower end of financial resources will not, in general, take up this property especially given a preference amongst families not to go into high rise if there is an alternative.

Since London's Green Belt puts a limit on available land, much in the way water and jurisdiction differences do for Manhattan, Hong Kong and Monaco, new high rise builders are unlikely to switch to undercutting existing prices.

More high rise within the Green Belt will mean higher land prices and consequent drift to occupying property with less amenity, such as gardens, and with less space per person.

Londoners have already made sacrifices on the space front and should not be required to make more.

Elections will not be won by promising more high rise or mansion taxes and subsequent ones will be lost when people find others have views from tower blocks into their previously private gardens or the taxes kick in and they have to sell out to someone better off than themselves.

High rise does have a function - it soaks up investment demand.

This is so the world over and and is a legitimate reason to build it. In a country running a balance of payments deficit, like Britain, it is a way to balance the books on the capital side of the account.

In London, a Middle East purchaser might want air conditioning and underground parking. A Far East purchaser might want three flats grouped together for family reasons. The existing London house stock does not cater for this any more than central Paris caters for buying a low rise house with garden.

A lot of thought has to go into where residential high rise is authorised.

Serving to soak up investment demand? - high rise near open space - Kattendijkdok, Antwerp

Eventually, high rise does ease some pressure on domestic housing markets because some of the flats come on the rental market at competitive rates - but much less than imagined.

I have been an advocate of Crossrail 2 and improved Underground to increase capacity but I am not under any illusion that public transport and London's road system would be able to handle greater residential density.

Victorian and Edwardian Underground stations are too closely packed to allow platform lengthening or, in most cases, additional high capacity exit routes because there is no space overground for exits either.

Deep piles from tower blocks mean new lines will have to be circuitous and ever deeper, restricting the number of stops as long escalators and walkways are out of the question.

London's roads are quite closely packed, too. Even with car usage not particularly high, central London is frequently jammed packed with buses, commercial vehicles, taxis, motorbikes and cycles moving at a crawl.

The names of the London and Tilbury docks are no longer common currency amongst Londoners. No one can remember which have been filled in and once they have been no one finds a need to mention them but for the purposes of the less costly end of the housing market it is probably the reaches of the Thames and old docklands that offer the best prospect.

Were the London boroughs collectively to acquire some of this land, conserve the development gain to themselves as did new town corporations, rent out a lot of what is built on differing length tenancies, selling on when the financing loans matured and connecting everything to the rail or Underground network, a non-partisan solution to providing lower cost housing for Londoners could be found.

What mix of low rise, medium rise and high rise one chose to have on new ground would be a matter of judgement and an accurate assessment of what the housing shortage in London really is.

To go down the route of more boroughs authorising residential high rise in the hope of some development gain would be a disaster.

____________________________________________________________________________

11 August 2015

So it sounds like it might be true - Taylor Swift is coming to live in Scotland. She's apparently a pretty good politician, too.

At the time of the beginning of her spat with Apple, Elvis Costello called her 'our future president'.

I remember hearing him live as a student and I didn't figure him as a political pundit, or as an American for that matter. So there's hope for us all as music critics if he's to be the cutting edge of political commentary.

But he's right. Now the talk is that the Republicans should run her in 2016.

Poor Labour. First outclassed by a female policitian in Scotland, Nicola Sturgeon. Now there's Swift.

Come on David Cameron, you don't have to rely on Boris for stardust, sign up Taylor Swift.

Would you vote for her in Scotland?

____________________________________________________________________________

25 August 2015

August is the silly season for news in Britain but beyond our silliness ('Och aye the NO!', as the Daily Mail says, Taylor Swift is not coming to live in 'the People's Republic of Sturgeon') when people say that today's young have been deprived of a future by today's political decisions, it is hard to agree.

They are trading in a different currency and learning quite different skills from their forebears.

It is true that many may be getting paid less, have less decision making in their jobs, being hedged in by procedures and regulations, and find it harder to acquire property early but this has toughened them into learning ways to achieve in spite of this.

They have acquired digital skills willy-nilly and this has taught them by observation that there are a plurality of ways to make a difference.

Indeed, when the 'digital generations' - say anybody under 35 - reach 40 perhaps they should ask 'have I made a difference?' because this may be the marker of achievement more than the things that mattered to their predecessors - pay, position, hierarchy.

Human nature does not change, though, and power games will still be played - with dominance rather than position being the defining characteristic at the pinnacle.

Taylor Swift is perhaps a case in point. Her royalties are not the same as employee pay, she has no position and no hierarchical authority over other singers yet she is the dominant female singer. She has also learned the ropes of the digital world, as witnessed by the way she has positioned herself relative to Apple and Spotify.

So with her at 25 years old would one vote for her?

Yes, with one proviso. In this new world, position may be worn like a campaign medal, as an honour to say one had been there, rather than to exercise the power which may increasingly no longer come with it. Dominance in the field you have chosen to make a difference in, if you have dominance, would be what is important to you, even if this gives no hierarchical authority. (Taylor Swift has a billion views for her video, no British politician would approach one thousandth of this).

So even though Vaclav Havel discharged his presidential duties diligently, two decades on one would not mind if his equivalent today concentrated on being, say, a dominant playwright whilst letting the staff run the state.

This is not to say an inept politician could do this. An exceptional one, like Havel, could do so now, not then.

None of this new world is confined to the young.

Warren Buffett has been the richest man in the world, or near enough, for ages. No one cares much what title he has. He runs the largest conglomerate in the world, or thereabouts, with only 25 staff, and no one cares what positions they hold other than to speculate as to his successor.

Although he has theoretical hierarchical authority over tens or hundreds of thousands of the conglomerate's employees, he shows no interest in exercising it. He is the world's dominant owner. Or the world's most successful investor.

In this new world there will be much greater scope to make a difference.

It will not detract from the difference you have made if one of your cohort achieves dominance if it offers no hierarchical authority over you.

One day those trading in this new currency will be in the majority and the world will be theirs.

This week three brave young Americans received France's highest honour for subduing a gunman on a train (there are four brave Europeans in this story, too). They made a difference.

____________________________________________________________________________

30 August 2015

Boris, of course, told Der Spiegel by 13 August that "thankfully there's not going to be a vacancy until late 2018 [for Prime Minister], if not later. By that stage, you know, a new generation of Tory thrusters will be sprouting like dragon's teeth. So the torch has been passed."

Can they all sing, though? If not, perhaps Boris should not give up hope.

____________________________________________________________________________

31 August 2015

I am pleased that the British Library has been listed Grade I. Well before all phases had nailed-down funding I interviewed Professor Colin St John Wilson (known to many architects as Sandy Wilson) about the design. I found him easy to talk to, not troubled by other people's intellectual boundaries. So after talking about the Library, we talked about his own modernist paintings and which ministers had been supportive of the project (one of whom I knew and whom he asked me to thank) and who not.

The article I wrote for Building Design expressed confidence that the building underway would turn out successfully as I had formed the view that Sandy Wilson was probably the best handler of pure modernism at the time in Britain.

The article soon became the reference article for the project.

Not long thereafter a lot of eminent people took to the media to be critical of the Library so Sandy sometimes just referred visitors to my article as a shortcut form of background briefing.

Later in life he blamed the virulence of attacks on the Library for the loss of his business but this could hardly have been the sole cause and he got his knighthood nonetheless.

He also acquired the knack of disposing of radio interviewers by not answering the question at all but persisting in saying what he had set out to say but such were the inbuilt prejudices against modernism amongst some that these tactics came across as more astute than discourteous.

In a previous generation there had been similar prejudice against Victorian Gothic so nothing was new. Architectural styles could produce hatred and still do but perhaps to a lesser extent in recent years.

Grade I listing is rare and very infrequent indeed for modernist buildings but Sandy Wilson had a strong sense of his historical sources and how his buildings should play in relation to them and so I am delighted for his architectural memory that this building has been listed so soon.

The Paolozzi sculpture of Newton in the forecourt of the British Library

____________________________________________________________________________

20 September 2015

With the Liberal Democrat party conference underway we can expect some wacky proposals on tax which ought to give voters some pause from voting for them.

As a publication we have been invited to hear Richard Murphy (the Labour leader's economic eminence grise) talk a couple of times and at least what he says is a known quantity - he is not targeting the middle class unlike Gordon Brown, who rhetorically targeted the rich but always made sure it was the middle class who paid, not the rich.

However, if it is left to the wild men of the Left - on the face of it John McDonnell (tax the top 10%, 60% income tax etc) and Sir Vince Cable - a lot of people will be footing the bill.

We would propose capitalism not through the prism of Marx as Mr McDonnell owns up to but capitalism that is actually about capital.

There is a strong chance that artificial intelligence and other technological developments will destroy a significant percentage of jobs permanently from 2020. The more families and individuals who have capital, the fewer the state will have to look after.

So we would take the counter-intuitive tack and abolish inheritance tax and personal capital gains tax and pay for this by abolishing both personal and corporate interest relief.

The disappearance of inheritance tax would lead to a massive repatriation of UK assets held overseas providing a large pool of capital for investment greater than the Liberal Democrats could ever imagine (as they are not going to print money). The focus of corporate investment in the UK would switch to being equity based, not geared, gently rebalancing the economy between commerce and finance without damaging the export potential of the City.

Those corporates that wished to continue receiving interest relief would have to do so through overseas vehicles - but many do so already.

The abolition of capital gains tax would greatly improve the mobility of assets semi-permanently tied up, stoke a have-a-try culture [1], and rebalance the investment culture as between individuals and institutions.

The precedent has already been set by the imaginative pension reforms in the last parliament. On first glance they are not finance industry friendly but the benefits of this liberalisation to individuals greatly outweigh the inconveniences.

____________________________________________________________________________

27 September 2015

For Jeremy Corbyn's speech to the Labour Party conference on Tuesday it is reported that 'his team have also decided to abandon the preceding musical fanfare, in favour of a more sober introduction for the new leader'.

Rumour has it that this will not prevent John McDonnell from appearing tomorrow to strains of Rain, Tax (It's Inevitable).

____________________________________________________________________________

25 October 2015

David Willetts always has something valuable to contribute but I do disagree with him linking a lack of housing for the young with pensioners' incomes.

[A problem here is that whilst writing books on intergenerational fairness he is the ex-minister most associated with raising university tuition fees. Has he not considered that the reason some of the young are at a disadvantage is due to the excessive preemption of resources by the corporate sector and not by pensioners?

The idea that capital tied up in pensioners' homes is fair game for use as current expenditure is also semi-farcical. Bank of England rules in practice mean that you can only borrow against income. The capital is only collateral that secures your loan if you have a good income. Try borrowing against capital alone. Tough! In other words, you are not going to be allowed to. Incidentally, this is anti-entrepreneurial as well. Try borrowing against income as a pensioner. Very difficult. Some pensioners sell up whilst they have all their faculties to provide for future expenditure but as a general precept to fund some new tax? Forget it.]

The lack of affordable housing is mainly a problem for London and the surrounding counties. Elsewhere, the problem is more likely to be the lack of well paid jobs.

The nub of the problem in London is land cost. If you build anywhere in London, the cost of the land makes the resultant dwellings expensive.

Theoretically, if you got a redundant airbase at agricultural land prices you could build perfectly acceptable homes starting for around £100,000 each. If you built to five stories high you could also get pretty high density on the site without the complications of tower blocks.

There is no such land in London so you would have to link it to the capital by a spur to a transport link. If you factored in the cost of the link and providing infrastructure, the homes would still be deliverable at low cost.

Only the government could provide such land. Private owners would require a premium well above agricultural land prices to relinquish land they might otherwise not want to sell.

It would be possible to finance construction privately and avoid state ownership but if that is done it also needs to be accepted that sales onto the open market would eventually have to take place to repay the financing.

It is possible that no such government owned sites exist but the principle is extendable provided you accept building in rural areas distant from other settlements. Then the premium payable for the land could be limited as it could reasonably be argued that development would not come to these locations at all without this special initiative.

____________________________________________________________________________

31 October 2015

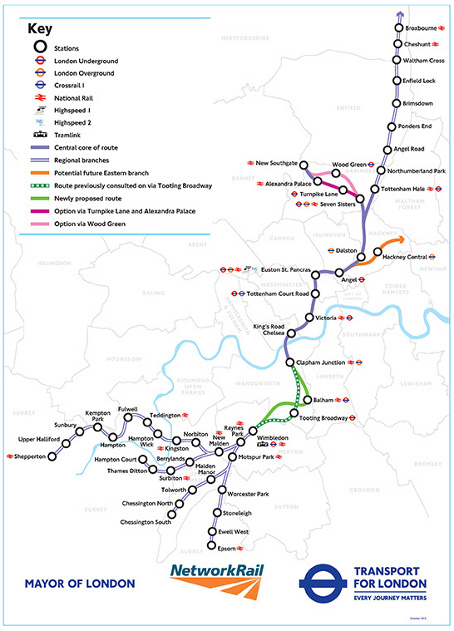

With the Mayor of London launching the final consultation for Crossrail 2, to run along a rather sound route from Wimbledon to New Southgate and to Tottenham Hale, and the Chancellor of the Exchequer announcing a National Infrastructure Commission, both in the same week, the possibility of an integrated affordable homes and transport strategy emerging for the London conurbation are enhanced.

It is now time for regional devolution of powers to deliver other packages elsewhere.

____________________________________________________________________________

10 November 2015

The proposal to allow houses in London to be extended upwards by two storeys if neighbours do not object is unappealing.

The building of new basements on adjoining land can be frightening occurences for property owners but the inconvenience is rarely for more than one year.

Overlooking and blocking of light, though, are the bane of city life. Without proper control over where windows go neighbouring gardens can go from pleasurable amenity to near unusable when closely overlooked and the addition of two storeys affords a view into almost all parts of neighbouring gardens.

Two storeys more upwards opposite you is likely to cut out a lot of the sky or even just the reflected light that lights your home.

If two storeys it has to be, unless neighbours object, then one up plus one down is preferable but the proposal is likely to fall foul of the accession of a new Mayor who may not take to it and pass the necessary bye-laws.

We have to bite the bullet and accept that more land will have to be found for housing and it is not beyond the reach of imagination to find it near some branch of the transport network.

____________________________________________________________________________

1 December 2015

When years ago Lord Wakeham was appointed to do an arbitration on the Channel Tunnel, I thought what a dream arbitration to do, especially as he was a politician not an arbitrator, judge or lawyer.

The Chartered Institute of Arbitrators, which was not involved in that arbitration, is in its centenary year and I have been a fellow of it for a quarter of its life.

Last week I attended the award of its Centenary Medal to Lord Woolf ahead of its Alexander Lecture.

The medal itself was a beautiful object, as remarked on by its recipient, and the lecture, What matters about arbitration?, given by V.V. Veeder QC, logically elegant to match.

The subject, in practice, was investor-state arbitration of investment disputes (Investor State Dispute Settlement, ISDS), touching especially on the provision for ISDS in the proposed Transatlantic Trade and Investment Partnership currently under negotiation.

Like most people who were present, I have no knowledge of investment disputes but I am well aware that much of the political left in Britain has been opposed to TTIP arbitration on the ground it would damage the NHS.

Now, if so many people have strong feelings about something and you have no contrary information my inclination is to let them have what they want.

In fact, nobody on the political right or amongst arbitrators has advanced contrary arguments, as one might expect if there were a case to argue, because there is no information at all on how the NHS would be affected.

So there is some mystification on this point and this was confirmed by answers to questions after the lecture.

Were the NHS to be affected it would be a bad thing but this would be so even if a very public court-based disputes resolution system were used.

Suffice it to say that the European Commission's public negotiating position is now that it does not want to use arbitration.

Two obvious problems arise.

The first is that a transnational court like the European Court of Justice or the International Criminal Court would be very expensive and cumbersome to administer, especially given the likely paucity of cases.

The second is where is the court going to be located in a neutral place notionally midway between Europe and America - Reykjavik, Canberra, Tokyo?